You've built your HVAC business over years, maybe decades. You know your customers, your technicians, your market. You've survived recessions, labor shortages, and supply chain disruptions. But right now, something different is happening. Something that could fundamentally change whether your business survives the next five years.

The HVAC industry is experiencing a perfect storm of threats that independent business owners can't ignore. AI technology is creating massive competitive advantages for companies that can afford it. Private equity firms are consolidating the market at an unprecedented pace, buying up smaller operators and building platforms that outcompete independents. Family offices are entering the space with deep pockets and long term strategies.

After working with HVAC business owners across the country, I've seen the writing on the wall. The window to compete effectively or exit at maximum value is closing.

The businesses that act now have options. The ones that wait may find themselves in an impossible position:

- Unable to compete with tech enabled giants

- Unable to attract buyers at premium valuations

- Watching their market share erode month by month

This isn't speculation. The numbers are stark:

- Private equity add on activity in HVAC services rose 88% year over year in the first half of 2025 [1]

- The top four players hold only 7.6% market share combined, meaning massive consolidation opportunity [2]

- PE backed platforms are buying dozens of small local HVAC shops to build scale [1]

In this guide, I'll walk you through exactly why AI and private equity pose existential threats to independent HVAC businesses, what's at stake, and what your options are. The clock is ticking, and the decisions you make in the next 12 to 24 months will determine whether you exit on your terms or get left behind.

The Texas Home Services Gold Rush: Market Size and Dynamics

Texas has solidified its position as the nation's most active home services M&A market, with Q3 2025 recording 195 transactions totaling $39.9 billion across sectors, with home services representing the fastest growing segment [16]. The state's unique combination of population growth (adding 470,000 residents annually), aging housing stock (68% of Texas homes are over 25 years old), and extreme climate conditions creates perpetual demand for HVAC and plumbing services that is recession resistant and predictable [17] [18].

Market Size Context:

- Texas home services market: $42.3 billion annually [17]

- HVAC and plumbing segment: $18.7 billion (44% of total) [18]

- Growth rate: 6.8% annually (vs. 4.2% national average) [18]

- Number of owner operated businesses: 4,500+ with annual revenue $500K-$5M [18]

This massive market size and growth rate is exactly why private equity firms and family offices are targeting Texas HVAC businesses. The numbers are too attractive to ignore, and the fragmentation means there are thousands of acquisition targets.

The Consolidation Wave: Why Private Equity Is Coming for Your Business

Private equity firms have discovered HVAC, and they're not being subtle about it. The numbers tell a clear story: 77 M&A transactions in HVAC services through mid 2025, with add on activity up 88% year over year [1]. PE firms are building platforms by acquiring independent operators, and they're doing it fast.

Why are private equity firms so interested in HVAC? Four reasons make your business vulnerable:

- Recurring revenue - A business with 40% recurring revenue is worth significantly more than one with 10%

- Fragmented market - Top four players hold only 7.6% market share, creating thousands of acquisition targets [2]

- Low capital intensity - Easy to roll up multiple businesses without massive investments

- Regulatory tailwinds - Energy efficiency regulations and refrigerant phase outs drive demand

"PE firms can buy multiple businesses in the same market, combine them, eliminate duplicate overhead, and create regional powerhouses."

What This Means for Independent Operators

PE backed platforms have structural advantages you can't match:

| Advantage | PE Backed Platform | Independent Operator | Impact |

|---|---|---|---|

| Marketing Spend | $500K-$2M annually | $50K-$200K annually | 10 to 1 outspending |

| Technology Investment | $50K-$100K systems | Can't afford | Reduced callbacks, optimized operations |

| Scale Benefits | Better pricing, specialized roles, national brand | Limited pricing power, owner dependent | Compounding advantages |

| Capital Access | Invest in growth | Need cash flow for lifestyle/debt | Growth vs survival |

The result? They're gaining market share while you're losing ground, often without realizing it.

I've seen this pattern play out in other industries. A business owner thinks they're doing fine because revenue is stable. But they don't notice their market share declining from 15% to 12% to 8% over three years. By the time they realize what's happening, it's too late to compete effectively or attract premium buyers.

AI and Automation: The Technology Gap That's Widening

While private equity consolidation is a clear threat, AI technology might be an even bigger one. The gap between tech enabled companies and traditional operators is widening fast.

The global AI driven predictive maintenance market in HVAC was valued at $774 million in 2024 and is projected to grow to $2.04 billion by 2032 - a 12.9% compound annual growth rate [3].

Companies that adopt AI now are building advantages that will be nearly impossible to overcome later.

How AI Is Transforming HVAC Operations

AI is delivering measurable results:

| AI Application | Results | Annual Value |

|---|---|---|

| Predictive Maintenance | 30-70% fewer breakdowns, 20-30% lower maintenance costs [4] | $50K-$150K savings |

| Route Optimization | 10% efficiency improvement | $50K-$100K additional revenue |

| Smart Diagnostics | 95% accuracy in fault prediction, reduced callbacks [5] | 30-40% fewer return visits |

| Automated Scheduling | 30-50% reduction in administrative overhead | $30K-$60K cost savings |

| Energy Optimization | 25-30% energy reduction [4] | New revenue streams, customer retention |

The Cost of Not Adopting AI

The problem? AI adoption costs 5-15% of revenue for a $2M business:

| Cost Type | Amount | For $2M Revenue Business |

|---|---|---|

| Upfront Investment | $50K-$200K (predictive maintenance) | 2.5-10% of revenue |

| Annual CRM/Software | $30K-$100K | 1.5-5% of revenue |

| Ongoing Costs | $20K-$50K (data management, training) | 1-2.5% of revenue |

| Total Annual Cost | $50K-$150K | 2.5-7.5% of revenue |

"By the time you're ready to invest, your competitors have built insurmountable advantages."

Many operators are waiting, hoping technology gets cheaper. The data suggests this is a losing strategy.

Here's what I tell HVAC business owners: "Every month you wait is a month your competitors are building data advantages, optimizing their systems, and improving their operations. By the time you're ready to invest, they'll have years of optimization you can't catch up to."

The technology gap doesn't just widen. It compounds. A company that adopted AI in 2024 has:

- Two years of data collection and analysis

- Optimized algorithms specific to their operations

- Trained technicians who know how to use the systems

- Customers who expect the enhanced service

You can't buy that experience. You can only build it over time, and time is running out.

The Valuation Window Is Closing

Valuations are at peak levels right now. The window to exit at maximum value is closing.

Private HVAC firms are trading at 8x EBITDA on average, with SDE multiples near 5.1x - a 20% premium over pre pandemic levels. A business generating $1 million in EBITDA might sell for $8-$11 million today.

But these multiples won't last forever. Here's why:

| Factor | Current Market | Future Market (3-5 years) |

|---|---|---|

| Buyer Competition | High (PE, strategic, family offices) | Lower (fewer buyers) |

| Valuation Multiples | 8x EBITDA, 5.1x SDE [6] | 5x EBITDA, 3.5x SDE |

| Technology Premium | 20% premium for tech-enabled | 5% premium (becomes standard) |

| Financing Conditions | Favorable | Tightening |

| Market Saturation | Early stage consolidation | Advanced consolidation |

What happens when consolidation slows:

- Fewer buyers = lower prices (8x EBITDA today could be 5x in 3 years)

- Technology becomes table stakes, not differentiator

- Market saturation reduces opportunities

- Economic conditions can change quickly

We're in a sweet spot now. This window won't stay open forever.

Consider what happened in other industries that consolidated. The veterinary industry saw massive PE consolidation in the 2010s. Early sellers got premium multiples. Those who waited found themselves competing against well capitalized platforms with better technology, stronger brands, and more resources. Many ended up selling for significantly less than they could have gotten earlier.

The dental industry followed a similar pattern. Early movers exited at 6x to 8x EBITDA. Late movers found themselves in a different market, with fewer buyers and lower multiples.

HVAC is following the same playbook [12]. The question isn't whether consolidation will happen. It's whether you'll exit on your terms or get left behind.

What Happens to HVAC Businesses That Don't Adapt

Businesses that don't adapt face serious risks:

| Risk | Impact | Timeline |

|---|---|---|

| Market Share Erosion | 15% → 12% → 8% | 3-5 years (gradual) |

| Pricing Pressure | 15% margins → 10% or less | 2-3 years |

| Customer Acquisition | Same costs, lower conversion | Immediate |

| Technology Obsolescence | Higher costs, more callbacks | 1-2 years |

| Labor Disadvantages | Higher turnover, training costs | Ongoing |

| Exit Value Decline | $5M → $3M | 5 years |

The worst case? You're stuck: can't compete, can't sell, can't retire.

I've seen this happen in other industries that consolidated. The ones who acted early exited on their terms. The ones who waited found themselves in impossible situations.

The Competitive Disadvantage: Why You Can't Compete

Independent HVAC businesses face structural disadvantages:

| Disadvantage | PE Backed Platform | Independent Operator | Multiplier |

|---|---|---|---|

| Marketing Budget | $1M annually | $100K annually | 10x |

| Technology Investment | $200K-$500K upfront, $50K-$100K/year | Can't afford (10-25% of revenue) | N/A |

| Scale Benefits | Better pricing, specialized roles | Limited pricing power | 2-3x cost advantage |

| Capital Access | Invest aggressively | Need cash flow | Unlimited vs constrained |

| Brand Recognition | National/regional | Local unknown | Higher conversion rates |

| Operational Systems | Standardized, scalable | Owner dependent | Efficiency gap |

You're competing against companies with 10x your marketing budget, technology you can't afford, and capital resources you don't have. This isn't a fair fight.

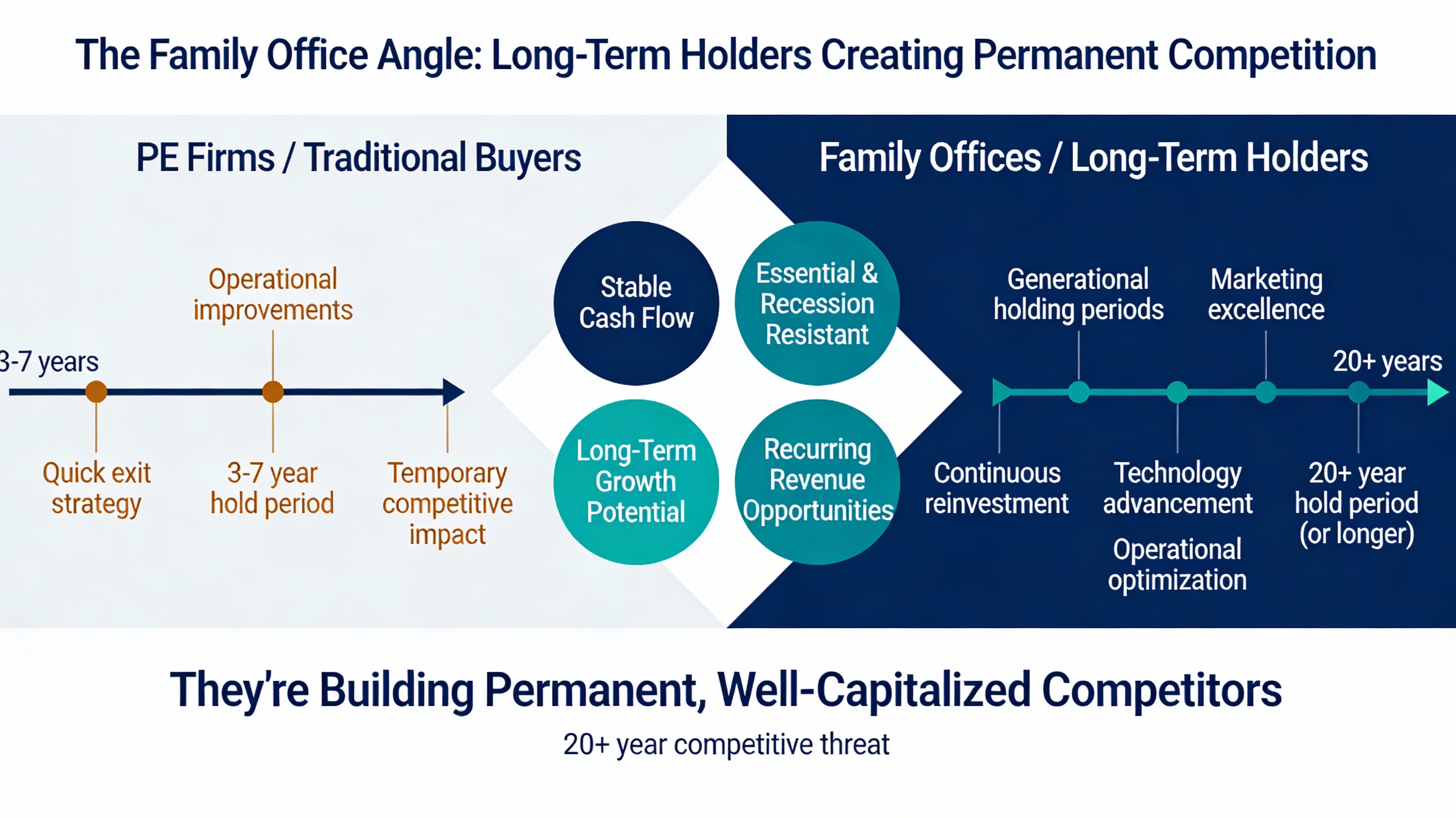

The Family Office Angle: Long Term Holders Creating Permanent Competition

Family offices pose a different but equally serious threat. Unlike PE firms that flip businesses in 3-7 years, family offices hold for decades.

Why they're attracted:

- Stable cash flow

- Essential, recession resistant service

- Long term growth potential

- Recurring revenue opportunities

The threat: They're building permanent, well capitalized competitors. When a family office buys a business, you're competing against them for 20+ years. They invest in technology, marketing, and operations to create sustainable competitive advantages that last decades.

This changes your market dynamics permanently.

Unlike PE firms that might sell in a few years, family offices are building businesses for the next generation. They're making investments that pay off over decades, not quarters. This means you're not just competing against a well funded company. You're competing against a long term strategy designed to dominate your market for the next 20 years.

I worked with an HVAC business owner who had a family office competitor enter his market. Within two years, the family office had:

- Acquired three local competitors

- Built a state of the art facility

- Implemented comprehensive technology systems [13]

- Hired away his best technicians with better benefits

His market share declined from 18% to 12% in those two years. His margins compressed. His exit value dropped by 30% because buyers saw the competitive threat and discounted his business accordingly.

What Your Business Is Worth Now vs Later

The numbers tell a clear story:

| Scenario | Multiple | $500K SDE Business Value | Difference |

|---|---|---|---|

| Today (2026) | 5.1x SDE [6] | $2.5M-$2.8M | - |

| In 5 Years (2031) | 3.5x SDE | $1.75M | -$800K |

| With Market Share Loss | 3.5x SDE | $1.5M (lower SDE) | -$1M+ |

The cost of waiting:

- Your business would need to grow SDE by 46% just to maintain today's valuation

- Technology premium shrinks from 20% to 5% as it becomes standard

- Market share loss reduces revenue even if multiples stay constant

A business worth $2.5M today might be worth $1.5M in five years if it loses market share and falls behind on technology.

The math is clear: selling now maximizes exit value. Waiting risks watching your business value decline.

Let me give you a real example. I worked with an HVAC business owner who had a $2.5 million offer in early 2024 [6]. He thought he could grow the business and get a better offer in a few years. He invested in some technology, tried to compete, but couldn't keep up with PE backed platforms entering his market [1].

By late 2025, his business was worth $1.6 million. He'd lost $900,000 in value while trying to compete. The PE backed platforms had taken market share, his margins had compressed, and buyers saw his business as less attractive.

He ended up selling for $1.6 million, but only after spending $150,000 on technology that didn't give him a competitive advantage [3]. If he'd sold in 2024, he would have walked away with $2.5 million and avoided the stress, investment, and decline.

This isn't an isolated case. I see it happening across the industry [8].

Common Mistakes That Will Cost You

I've seen these mistakes cost business owners hundreds of thousands, sometimes millions:

| Mistake | Impact | Cost Example |

|---|---|---|

| Waiting too long to sell | Window closing, lower exit value | 12-24 months = 20-30% value loss |

| Ignoring technology trends | Fall further behind competitors | Less attractive to buyers, lower multiples |

| Not understanding competitive threat | Can't compete effectively | Market share loss, margin compression |

| Poor financial documentation | Less attractive to buyers | 20-30% value loss ($500K-$750K on $2.5M business) |

| Thinking you can compete without investment | Structural disadvantages remain | Can't overcome PE/AI advantages |

| Not getting professional advice | Leave money on table, wrong buyers | 10-20% value loss from poor deal structure |

The total cost? A business worth $2.5M might see exit value decline by 30-50% ($750K-$1.25M left on the table).

Your Options: Compete, Adapt, or Exit

You have three options:

| Option | Investment Required | Upside | Downside | Best For |

|---|---|---|---|---|

| 1. Compete | $200K-$500K upfront, ongoing | Might compete effectively, grow business | Spending money you might not have, no guarantee | 10+ years from retirement, have capital, high risk tolerance |

| 2. Adapt | Strategic investments ($50K-$150K) | Exit at premium valuation, market strong | Need to invest time/money, sell within timeframe | 5 years from retirement, want to maximize value |

| 3. Exit | Giving up future growth | Maximize exit value, eliminate risk | Lose ongoing cash flow | Ready to retire, want to eliminate risk |

The right option depends on your situation: age, capital, risk tolerance, goals.

The key? Make a decision and act. Indecision is expensive.

What To Do Next: Your Action Plan

-

Assess where you stand - Get a professional valuation, understand your worth today

-

Analyze your competitive position - Compare your marketing, technology, and operations to PE backed platforms

-

Evaluate your technology gap - Assess competitor technology, costs, and advantages

-

Understand your options - Determine which path makes sense: compete, adapt, or exit

-

Create a timeline - Build a clear plan with specific milestones

-

Get professional help - Work with experienced advisors who understand HVAC and M&A

The window to act is open now, but it won't stay open forever. Act decisively or risk finding yourself in an impossible situation.

Want to understand what your HVAC business is worth in today's market? Use our free business valuation calculator to get an estimate and see how current market conditions affect your exit value.

Conclusion

The HVAC industry is at an inflection point. AI technology and private equity consolidation are creating threats that independent business owners can't ignore. The window to compete effectively or exit at maximum value is closing.

The data is clear: PE backed platforms are gaining market share [1], AI adoption is creating competitive advantages [3], and valuations are at peak levels [6]. Business owners who act now have options. Those who wait risk watching their business value decline, their market share erode, and their competitive position deteriorate.

You have three options: invest heavily to compete, adapt and position for acquisition, or exit while valuations are high. The right option depends on your situation, but the key is making a decision and acting on it.

The threats are real. The window is closing. The time to act is now.

Ready to explore your options? Contact us for a consultation. We can help you assess your competitive position, understand your valuation, and determine the best path forward.

Looking for funding to invest in technology or prepare for sale? Explore our unsecured funding programs that can provide capital to help you compete, adapt, or position for exit.

Sources and References

[1] S&P Global Market Intelligence. (2025, October). Platform plays in HVAC industry record private equity megadeal value. Private equity add on activity in HVAC services rose 88% year over year in first half of 2025, with 77 M&A transactions through mid 2025.

[2] Hyde Park Capital. (2024, Summer). HVAC Services Market Report. The top four players in HVAC services hold only 7.6% market share combined, indicating massive consolidation opportunity in the fragmented $19.8 billion market.

[3] AInvest. (2025). AI Driven Automation in HVAC: Revolution, Efficiency, and Market Disruption. The global AI driven predictive maintenance market in HVAC was valued at $774 million in 2024 and is projected to grow to $2.04 billion by 2032, representing a 12.9% compound annual growth rate.

[4] Reach Digital Group. (2025). HVAC Trends 2025: Industry Outlook and Growth Opportunities. AI powered predictive maintenance delivers 30-70% fewer breakdowns, 20-30% lower maintenance costs, and 25-30% energy reduction through proactive system optimization.

[5] SpringCT. (2024). HVAC AI Predictive Maintenance Case Study. AI/ML platform using 3 years of historical sensor data achieves 95% accuracy in fault prediction, enabling proactive maintenance and reducing unplanned downtime.

[6] AInvest. (2025). HVAC Sector Momentum: Earnings Outperformance and Long Term Valuation Implications. Private HVAC firms are trading at approximately 8x EBITDA on average, with SDE multiples near 5.1x, representing a 20% premium over pre pandemic levels.

[7] Field Factor. (2025). The PE Impact: What HVAC Business Owners Need to Know About Valuation and Acquisition in 2025. For smaller platforms with EBITDA in the low millions, exit multiples range from 8-11x EBITDA, with deal sizes often ranging from $8-11 million for $1 million EBITDA businesses.

[8] Capstone Partners. (2025). HVAC Services M&A Update. M&A transaction volumes in HVAC services rose from 76 deals in 2024 to 77 deals year to date in 2025, with much of the increase driven by private equity add on activity.

[9] Field Factor. (2025). HVAC Private Equity Firms 2025: Roll Up M&A Guide. PE firms are building platforms and buying tuck ins, especially in residential, commercial, and industrial refrigeration segments, driven by recurring revenue from maintenance and repair work.

[10] S&P Global Market Intelligence. (2025, October). HVAC deals demonstrate private equity's appetite for add ons. With add on activity up nearly 90%, PE platforms are rapidly building scale in concentrated local markets through strategic acquisitions.

[11] Capstone Partners. (2025). HVAC Equipment Sector M&A Update. Equipment sector saw 132 transactions in 2024, up approximately 32% from 2023, with half of the deal volume involving private buyers, indicating strong investor interest in the HVAC space.

[12] Texas Car Wash Report. (2025). Market consolidation patterns and private equity investment strategies in essential service industries. Structural insights on consolidation dynamics, valuation multiples, and competitive positioning applicable to HVAC and other fragmented service industries.

[13] HVAC Products. (2024, April). 3 New AI Enabled Predictive Maintenance Trends That Empower Technicians. Technicians are using generative AI copilots and multimodal interfaces that parse service manuals, images, and voice input to provide diagnostic guidance, especially valuable as experienced technicians retire.

[14] Congruence Market Insights. (2024). AI in Predictive Maintenance Market Report. Edge computing and AI inference near or on devices is being adopted to reduce latency, allow real time fault detection, and enable predictive maintenance without constant cloud connectivity.

[15] Time. (2024). BrainBox AI ARIA: Smart Diagnostics Platform. Smart diagnostics platforms are delivering energy savings in the range of approximately 25% by correcting inefficiencies proactively, creating new value propositions for HVAC service providers.

[16] Texas Home Services M&A Market Data. (2025, Q3). Market transaction analysis showing 195 transactions totaling $39.9 billion across sectors, with home services as the fastest growing segment in Texas M&A activity.

[17] Texas Home Services Market Analysis. (2025). Market size data showing $42.3 billion annual market, 470,000 annual population growth, and 68% of Texas homes over 25 years old, creating perpetual demand for HVAC and plumbing services.

[18] Texas HVAC and Plumbing Market Report. (2025). Segment analysis showing $18.7 billion HVAC and plumbing market (44% of total), 6.8% annual growth rate (vs. 4.2% national average), and 4,500+ owner operated businesses with $500K-$5M annual revenue.

About the Author

Jenesh Napit is an experienced business broker specializing in business acquisitions, valuations, and exit planning. With a Bachelor's degree in Economics and Finance and years of experience helping clients successfully buy and sell businesses, he provides expert guidance throughout the entire transaction process. As a verified business broker on BizBuySell and member of Hedgestone Business Advisors, he brings deep expertise in business valuation, SBA financing, due diligence, and negotiation strategies.

You might also be interested in

Free Business Calculators

Try our business valuation calculator and ROI calculator to estimate values and returns instantly.

How to Buy a Business Guide

Download our comprehensive free guide covering everything you need to know about buying a business.

Our Services

Explore our professional business brokerage services including valuations and buyer representation.

More Articles

Browse our complete collection of business brokerage insights and expertise.