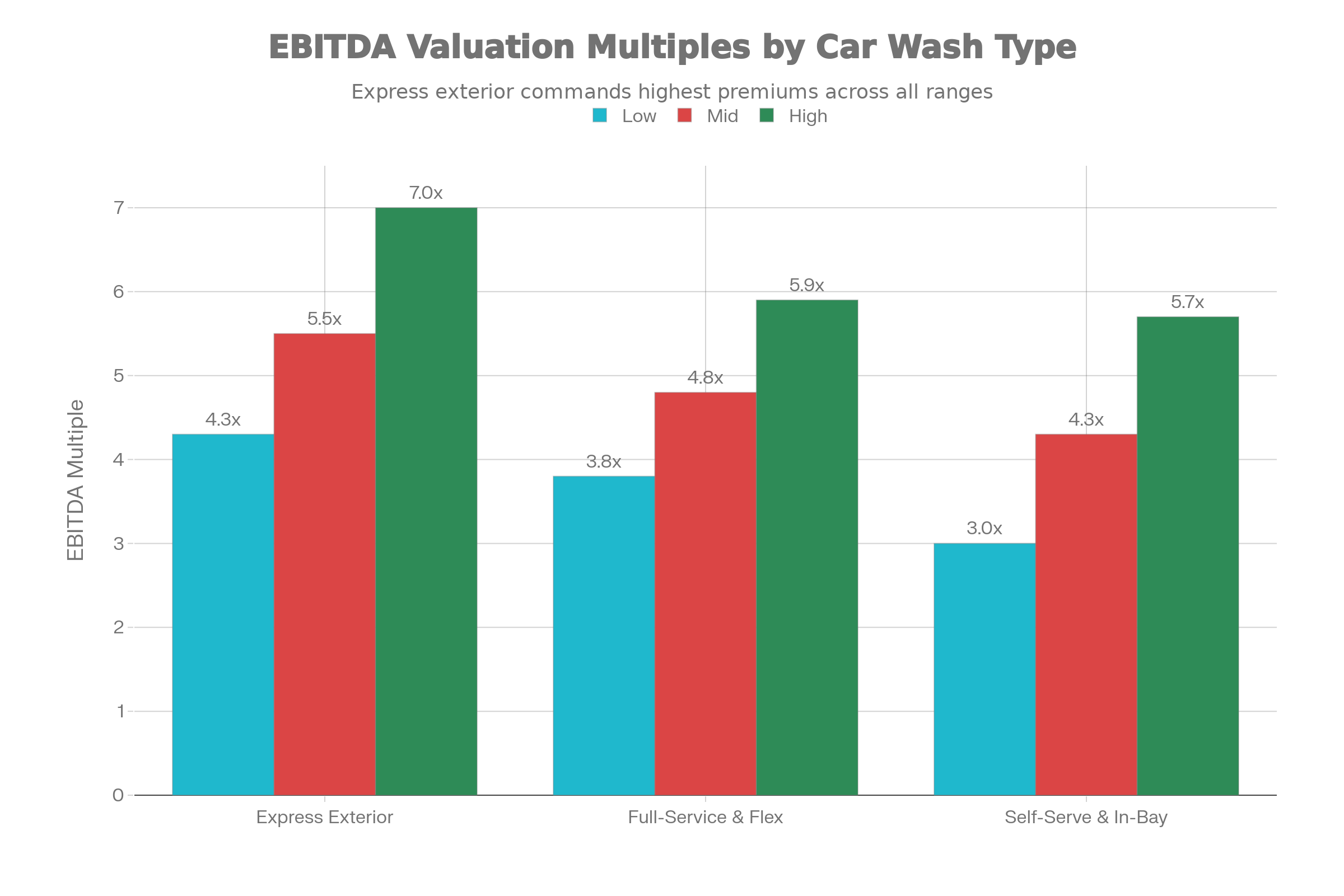

The Texas car wash market is experiencing a major consolidation wave driven by private equity groups, institutional platforms, and sophisticated regional operators. Current market data shows median asking prices of $412,500 for Texas car washes, with SDE multiples ranging from 3.7x to 8.2x (median 5.85x) and EBITDA multiples from 3.6x to 6.9x [2]. Express exterior tunnels with strong membership programs are commanding the highest multiples, often reaching 4.3x to 7.0x EBITDA [8].

Private equity backed platforms like Mammoth Holdings, Caliber Car Wash, ClearWater Express Wash, Quick Quack, and Mister Car Wash are actively acquiring Texas locations, creating unprecedented demand for quality assets [16]. This consolidation cycle presents a unique opportunity for Texas car wash owners who understand how their businesses are valued and who is buying.

After working with car wash owners across Texas, I've seen the pattern: owners who prepare properly and understand valuation drivers achieve sale prices well above historical norms. Those who don't understand the market often leave money on the table or struggle to attract serious buyers.

The single biggest differentiator I see between sellers who achieve premium valuations and those who don't: preparation. The owners who invest 6 to 12 months getting their financials organized, membership numbers up, and operations documented consistently attract better buyers and higher offers.

This guide covers everything you need to know about selling your Texas car wash, from understanding valuation multiples to identifying the right buyers and preparing your business for maximum value. I'll walk you through the current market dynamics, valuation methods, buyer types, and practical steps to position your car wash for a successful sale.

Download the full report here.

Enter your name and email to receive the complete Texas Car Wash Report PDF.

Texas Car Wash Market Overview

The Texas car wash market is one of the most active M&A markets in the United States. Population growth, strong vehicle ownership rates, and generally favorable weather patterns contribute to attractive unit economics for well located washes.

Business for sale marketplaces show dozens of car wash listings across Texas at any given time. According to BizBuySell [1], the median asking price for Texas car washes is $412,500, with median revenue of $240,000 and median SDE of $90,361. The market is diverse, ranging from sub $200,000 self service sites to multi million dollar express tunnel portfolios [4].

The Texas marketplace is divided into two broad segments:

Institutional grade assets are multi site express tunnels or large single sites with strong memberships, modern equipment, and high traffic counts. These are typically targeted by private equity backed platforms and larger strategic buyers.

Independent operations are single site or small portfolios, often older or with less sophisticated membership programs. These are more likely to be acquired by independent investors, family offices, or first time buyers transitioning out of corporate roles.

Market Activity and Inventory

Texas car wash listings appear across multiple platforms:

- BizBuySell lists diverse inventory including express tunnels, flex serve operations, self serve bays, and full service facilities [1]

- BizQuest shows multiple pages of Texas car wash listings with asking prices ranging from approximately $170,000 to $43 million depending on size, model, and real estate [4]

- LoopNet similarly shows active inventory across Texas markets [7]

- Specialized brokerage sites such as CarWashKing and niche platforms like Realmo and CarWashAdvisory further confirm healthy inventory and active buyer interest [10]

The median annual revenue across Texas car washes for sale is $240,000, with median SDE of $90,361 [1]. This data reflects a mix of business models and market positions, from established express tunnels to smaller independent operations.

How Car Washes Are Valued: SDE, EBITDA, and Revenue Multiples

Valuing a car wash correctly is central to a successful sale. Buyers rely on three primary metrics: Seller's Discretionary Earnings (SDE) for owner operator deals, EBITDA for institutional operations, and revenue multiples as a cross check.

Key insight: Car washes trade at a significant premium to typical main street businesses. While many small businesses sell for 2.4x to 4.2x SDE, quality car washes routinely achieve 3.7x to 8.2x. This premium reflects the industry's strong fundamentals: recurring membership revenue, favorable demographics, and intense buyer competition from private equity platforms.

SDE Multiples

SDE represents the total financial benefit a single full time owner operator receives from the business, including net profit before owner's salary, owner's wages and payroll taxes, discretionary expenses, and certain non recurring or clearly personal expenses.

Industry valuation analyses show that across car washes, SDE multiples often range from 3.7x to 8.2x, with a median around 5.85x in many recent transaction samples [2]. This is materially higher than the 2.4x to 4.2x SDE range typical for many main street businesses, reflecting the quality of cash flow and industry tailwinds.

For example, if a Texas express car wash generates $190,000 in normalized SDE, a buyer might value it in the range of:

- Low end (3.7x): $703,000

- Mid market (5.0x to 6.0x): $950,000 to $1,140,000

- Upper range (7.0x to 8.2x): $1,330,000 to $1,560,000

The actual multiple applied depends on business model, membership penetration, real estate, and risk factors.

Want to understand what your car wash might be worth? Use our free business valuation calculator to get an estimate based on current market conditions.

EBITDA Multiples

EBITDA is the preferred metric for private equity buyers and larger strategic acquirers, as it reflects earnings after a normalized management structure.

Recent studies of car wash valuation multiples report overall industry EBITDA multiples of approximately 3.6x to 6.9x across car washes of varying sizes [2]. By business model: express exterior washes trade at roughly 4.3x to 7.0x EBITDA due to their scalable, subscription friendly model; full service and flex serve washes typically trade at 3.8x to 5.9x EBITDA, with higher labor intensity and sensitivity to economic cycles; and self serve and in bay automatic sites often trade at 3.0x to 5.7x EBITDA, reflecting lower throughput and more commodity like operations [8].

A Texas express tunnel generating $400,000 of EBITDA might therefore trade between approximately $1.7 million (4.3x) and $2.8 million (7.0x), with top tier assets gravitating toward the higher end.

Revenue Multiples

Revenue multiples provide a quick cross check for valuation. National benchmarks show revenue multiples from approximately 0.47x to 1.08x for general car wash businesses [2]. Express washes with strong recurring revenue and high margins can achieve total enterprise value effectively in the 2.0x to 3.6x revenue range when translated from higher EBITDA multiples and margins [8].

For example, a wash with $724,000 in revenue and a 0.84x revenue multiple would be valued around $608,000 [2]. For higher growth subscription driven washes, the implied revenue multiple can be substantially higher because EBITDA margins are so strong.

Key Drivers of Valuation Multiples

Several factors systematically influence where a particular Texas car wash falls within these valuation ranges.

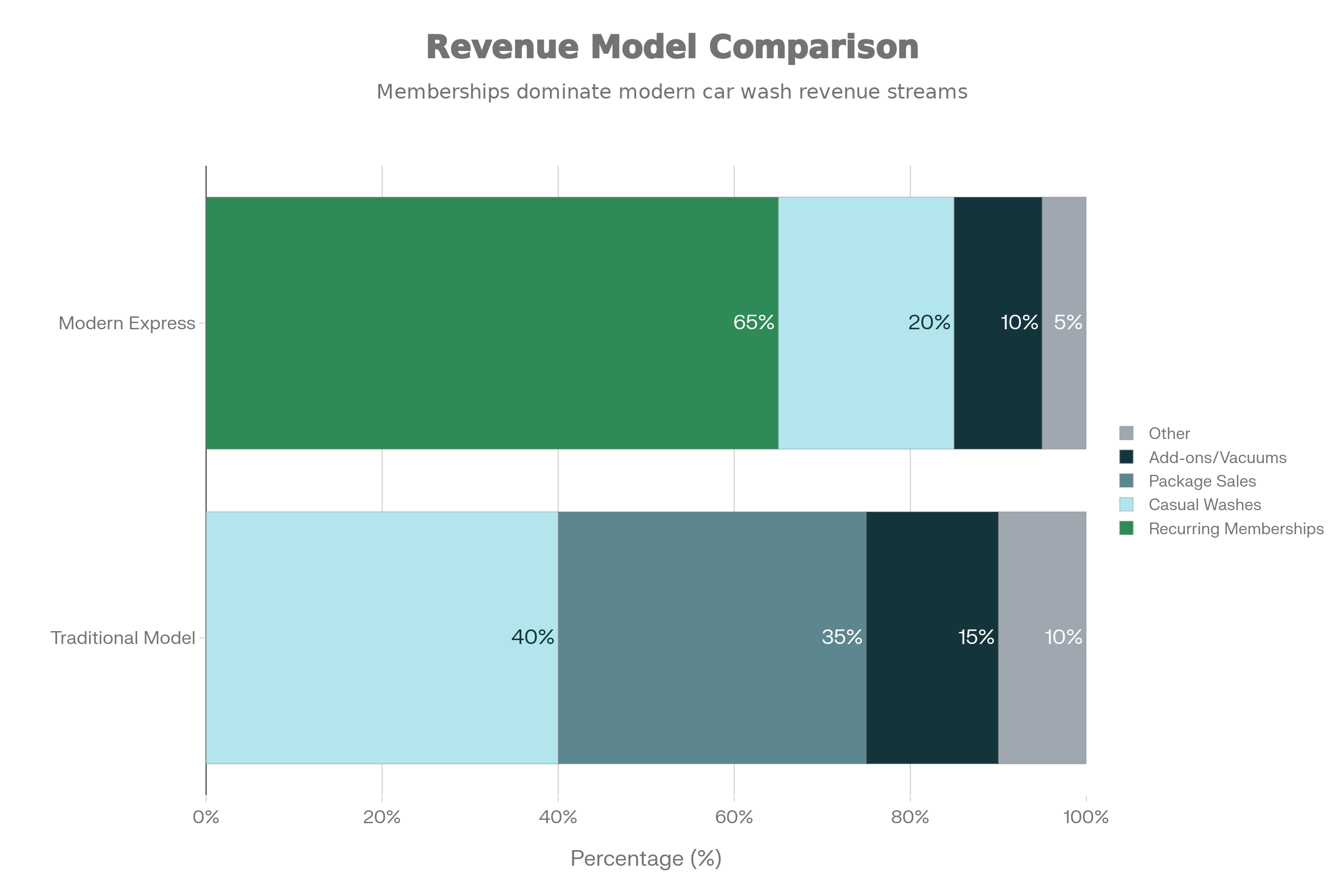

What separates a 4x multiple from a 7x multiple? It often comes down to six positive drivers that institutional buyers pay for: business model (express vs full service), membership penetration, location quality, real estate ownership, equipment condition, and financial performance trends. Address these before going to market, and you'll have more leverage in negotiations.

Positive Drivers (Push Multiples Up)

| Driver | Impact |

|---|---|

| Business Model | Express exterior washes with unlimited wash club programs are favored by private equity and large platforms due to throughput, margin, and scalability [14]. These models generate predictable recurring revenue and require less labor than full service operations. |

| Membership Penetration and Recurring Revenue | Top operators generate 60 to 75% of revenue from memberships. Mister Car Wash, for example, derives about 74% of revenue from its Unlimited Wash Club [14]. High membership penetration signals predictable cash flow and reduces customer acquisition costs. |

| Location Quality and Traffic Counts | High visibility corner locations with strong traffic counts command premium multiples. Buyers pay for locations that drive consistent volume without heavy marketing spend. Prime locations in growing suburban corridors are particularly attractive. |

| Real Estate Ownership | Owning the real estate can significantly increase total transaction value. Some investors are willing to pay premium prices for mission critical, single tenant net lease properties [20]. Alternatively, sellers can retain real estate and become landlords, creating long term income streams. |

| Modern Equipment and Technology | Updated equipment reduces maintenance costs and improves customer experience. Modern payment systems, membership management software, and automated processes reduce operational complexity and increase appeal to institutional buyers. |

| Strong Financial Performance | Consistent revenue growth, improving margins, and strong cash flow generation all support higher multiples. Buyers pay premiums for businesses with demonstrated performance trends. |

Negative Drivers (Push Multiples Down)

| Driver | Impact |

|---|---|

| Aging Equipment | Older equipment requires significant capital investment, reducing net proceeds after necessary upgrades. Buyers factor in required equipment replacement when making offers. |

| Low Membership Penetration | Operations with low membership rates face higher customer acquisition costs and less predictable revenue. Buyers discount these businesses due to increased risk. |

| Poor Location or Declining Traffic | Locations with declining traffic patterns or poor visibility reduce buyer interest. These factors limit growth potential and increase operational risk. |

| Owner Dependency | Businesses that rely heavily on the owner's personal involvement reduce transferability and increase transition risk. Buyers discount owner dependent operations. |

| High Labor Intensity | Full service operations with high labor costs face margin pressure and operational complexity. These factors typically result in lower multiples compared to express models. |

| Environmental or Regulatory Issues | Properties with environmental concerns or regulatory compliance issues create risk and reduce value. Buyers require clean environmental reports and regulatory compliance. |

Who's Buying Texas Car Washes: Private Equity vs Independent Investors

Understanding who is buying car washes in Texas helps you position your business and identify the right buyer type for your situation.

| Buyer Type | Typical Deal Size | What They Look For | Key Characteristics |

|---|---|---|---|

| Private Equity Platforms | Multi site or EBITDA $500K+ | Express tunnels, strong memberships, expansion potential | Rollover equity, faster closings, nationwide/regional networks |

| Independent Investors & Family Offices | $200K to $1M SDE | Single sites, owner operator models, real estate | Flexible structures, may require seller financing or transition support |

| Strategic Regional Operators | Varies by market | Single sites or small portfolios in target geographies | Build density in DFW, Houston, Austin, San Antonio; value synergies |

| First Time Buyers | Under $500K value | Smaller operations, training opportunity | Often need SBA financing, seller financing, or extended due diligence |

Private Equity Backed Platforms

Private equity groups are the dominant buyers for multi site and high volume express locations. These platforms are building regional networks and consolidating markets.

Major Players in Texas:

- Mammoth Holdings has expanded into Texas with acquisitions including Today's Car Wash and Galaxies Express Car Wash in Killeen [9]

- Caliber Car Wash expanded into Texas with the acquisition of Q Car Wash [3]

- ClearWater Express Wash acquired BlueWave Express Car Wash, expanding their Texas presence [6]

- Quick Quack Car Wash has explored minority stake sales and maintains active acquisition programs [15]

- Mister Car Wash operates nationwide with significant Texas presence and derives 74% of revenue from memberships [14]

These platforms typically target:

- Multi site portfolios or single sites with expansion potential

- Express exterior tunnels with strong membership bases

- Locations in high growth markets with demographic tailwinds

- Modern equipment and technology infrastructure

- EBITDA of $500,000 or more (though smaller deals occur)

Private equity buyers often offer:

- Rollover equity, allowing sellers to reinvest a portion of proceeds

- Potential tax deferral benefits in certain structures

- Upside participation as the buyer continues to scale

- Faster closings due to streamlined processes

Independent Investors and Family Offices

Independent investors and family offices remain active in smaller deals and single site acquisitions. These buyers often:

- Target businesses with $200,000 to $1 million in SDE

- Prefer owner operator models where they can be hands on

- Value real estate ownership as part of the transaction

- Offer more flexible deal structures

- May require seller financing or transition periods

Strategic Regional Operators

Regional operators are building density in specific markets, acquiring locations within drive time radius to increase marketing efficiency and operational leverage. These buyers often:

- Focus on specific geographic markets (DFW, Houston, Austin, San Antonio)

- Acquire both single sites and small portfolios

- Integrate acquisitions into existing operations

- Value operational synergies and cost savings

First Time Buyers

First time buyers transitioning from corporate roles are active in the market, particularly for smaller operations. These buyers often:

- Target businesses under $500,000 in value

- Require seller financing or SBA loans

- Value training and transition support

- May need more time for due diligence and financing

Need help identifying the right buyer for your car wash? Contact me to discuss your situation and explore buyer options.

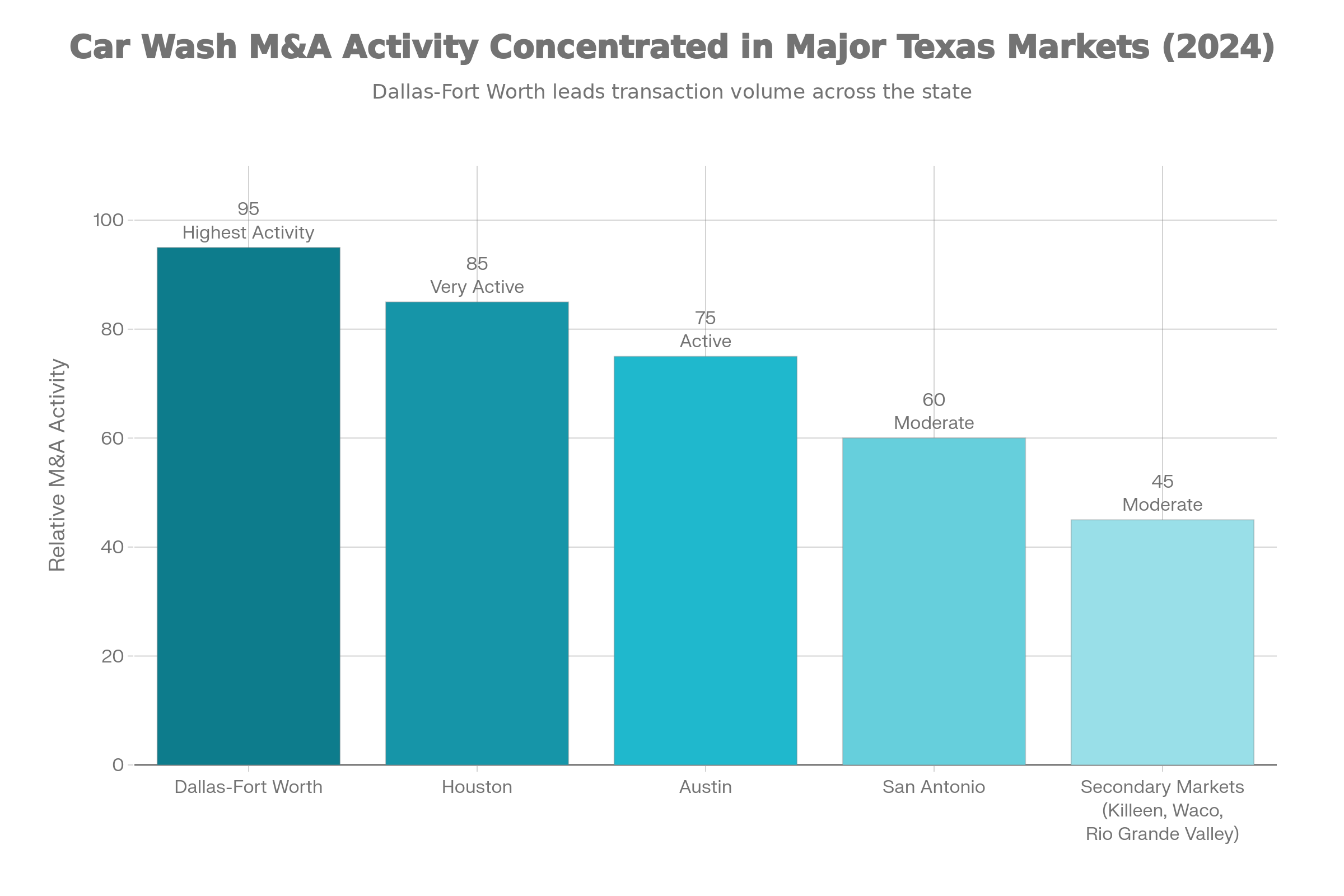

Geographic Hotspots in Texas

While car washes are found statewide, transaction activity is particularly concentrated in specific markets that attract institutional buyers.

| Market | Key Characteristics | Buyer Activity |

|---|---|---|

| Dallas Fort Worth (DFW) | Focal point of consolidation; dense clustering of express tunnels; strong population growth and demographics | Platform buyers building regional networks [9] |

| Houston | Strong suburban growth corridors; heavy traffic volumes; attractive unit economics | Both platform and independent buyers; supports multiple express tunnel locations |

| Austin & San Antonio | High growth metros; favorable demographics and population trends | Platform buyers filling in regional networks [9] |

| Secondary Markets (Killeen, Waco, Rio Grande Valley) | Platforms expanding beyond major metros; underserved areas | Opportunities for buyers seeking to build density [9] |

These markets attract institutional buyers because they can build density (multiple locations within a drive time radius), which increases marketing efficiency and operational leverage.

Preparing Your Car Wash for Sale

Proper preparation significantly increases your sale price and reduces time to close. Buyers expect organized financials, documented operations, and clear growth potential.

From the buyer's perspective: When evaluating a car wash, institutional buyers ask three questions: Can I verify the numbers? Can this business run without the current owner? What capital will I need to invest after closing? The sellers who can answer these questions confidently and provide supporting documentation move to the front of the line.

Financial Preparation

-

Organize Financial Records: Compile three years of financial statements, tax returns, and supporting documentation. Ensure all records are accurate, complete, and professionally prepared. Disorganized financials raise red flags and reduce buyer confidence.

-

Calculate Normalized SDE or EBITDA: Work with your CPA to calculate normalized earnings, identifying all add backs and adjustments. Common add backs include: owner's salary above market rates, personal expenses run through the business, one time or non recurring expenses, depreciation and amortization (for EBITDA), and interest expense (for EBITDA).

-

Document Revenue Streams: Break down revenue by source: membership revenue, single wash revenue, add on services, and other income. Highlight membership revenue percentage and growth trends. Buyers value predictable recurring revenue.

-

Show Growth Trends: Demonstrate consistent revenue growth, improving margins, or stable performance. Buyers pay premiums for businesses with positive trends. If growth has been flat, explain why and show potential for improvement.

Operational Preparation

-

Document Standard Operating Procedures: Create written procedures for daily operations, maintenance schedules, employee management, and customer service. Documented systems increase transferability and reduce buyer risk.

-

Upgrade Equipment Strategically: Invest in equipment upgrades that increase value without overcapitalizing. Modern payment systems, membership management software, and well maintained equipment reduce buyer concerns about capital requirements.

-

Optimize Membership Programs: Focus on growing membership penetration before sale. Higher membership rates directly increase valuation multiples. Implement marketing programs to convert single wash customers to members.

-

Reduce Owner Dependency: Train managers and employees to operate independently. Reduce your daily involvement to demonstrate the business can run without you. Owner dependent businesses command lower multiples.

-

Address Maintenance Issues: Complete deferred maintenance and address any equipment or facility issues. Buyers will discover problems during due diligence, and addressing them upfront prevents renegotiation or deal failure.

Legal and Regulatory Preparation

-

Ensure Compliance: Verify all licenses, permits, and registrations are current and in good standing. Address any regulatory issues or violations before going to market.

-

Review Contracts: Organize all customer contracts, vendor agreements, and lease documents. Ensure key contracts are assignable and have reasonable terms. Identify any contracts that might concern buyers.

-

Environmental Due Diligence: Conduct Phase I environmental assessment if not already completed. Address any environmental concerns proactively. Clean environmental reports are essential for institutional buyers.

-

Entity Structure: Ensure your business entity is in good standing with the Texas Secretary of State. Many buyers form LLCs for acquisitions. If you need help setting up an entity structure, Northwest Registered Agent can assist with formation and registered agent services.

Common Mistakes to Avoid When Selling

Avoiding common mistakes can save you significant time and money during the sale process.

The cost of getting it wrong: I've watched deals fall apart and sellers leave six figures on the table because of avoidable mistakes. The good news? Most of these errors are preventable with proper planning and the right advisors. Here are the seven mistakes I see most often and how to avoid them.

-

Pricing Too High or Too Low: Setting an unrealistic asking price scares away serious buyers or leaves money on the table. Work with a business broker or valuation professional to establish a defensible asking price based on market data and comparable sales.

-

Incomplete Financial Documentation: Disorganized or incomplete financial records create buyer skepticism and delay due diligence. Invest time in organizing financials before going to market. Professional financial statements increase buyer confidence and support higher valuations.

-

Hiding Problems: Attempting to hide problems or issues will be discovered during due diligence and can kill deals. Disclose issues upfront and explain how they've been addressed. Transparency builds trust and prevents last minute renegotiation.

-

Not Understanding Buyer Types: Different buyer types have different requirements and valuation approaches. Understanding who is likely to buy your car wash helps you prepare appropriately and target the right buyers.

-

Poor Timing: Selling during slow seasons or when the business is underperforming reduces value. Time your sale when the business is performing well and market conditions are favorable.

-

Inadequate Preparation: Going to market unprepared leads to delays, reduced offers, and failed deals. Invest in proper preparation before listing your car wash for sale.

-

Not Working with Professionals: Attempting to sell without professional help often results in lower prices and longer timelines. Experienced business brokers, attorneys, and CPAs add significant value and help avoid costly mistakes.

What To Do Next: Steps to Maximize Value

If you're considering selling your Texas car wash, here are the practical steps to maximize value and ensure a successful sale.

-

Get a Professional Valuation: Work with a business broker or valuation professional to understand what your car wash is worth in today's market. A professional valuation considers your specific situation, market conditions, and comparable sales. This establishes a realistic asking price and helps you evaluate offers.

-

Prepare Your Financials: Organize three years of financial statements, tax returns, and supporting documentation. Calculate normalized SDE or EBITDA with your CPA. Ensure all records are accurate and professionally prepared.

-

Optimize Operations: Focus on growing membership penetration, reducing owner dependency, and addressing any operational issues. Document standard operating procedures and ensure equipment is well maintained. These improvements directly increase valuation.

-

Identify the Right Buyer Type: Determine whether your car wash is attractive to private equity platforms, independent investors, or other buyer types. This helps you target the right buyers and prepare appropriately.

-

Work with Experienced Professionals: Engage a business broker experienced in car wash transactions, a business attorney familiar with M&A deals, and a CPA who understands business sales. These professionals help you avoid mistakes and maximize value.

-

Consider Real Estate Strategy: Decide whether to include real estate in the sale or retain it as a landlord. Each approach has different tax and income implications. Consult with your advisors to determine the best strategy for your situation.

-

Prepare for Due Diligence: Organize all documentation buyers will request: financial records, contracts, leases, environmental reports, and operational documentation. Being prepared accelerates due diligence and reduces buyer concerns.

Ready to explore selling your Texas car wash? Contact me to discuss your situation and develop a strategy to maximize value.

Conclusion

The Texas car wash market offers a compelling exit environment for well run operations, particularly express exterior tunnels with strong membership programs and quality real estate. Current valuation data shows SDE multiples commonly ranging from 3.7x to over 8x, with car washes trading at a premium relative to many main street businesses [2]. EBITDA multiples for desirable express assets can reach 6x to 7x or higher, especially when backed by robust memberships, modern equipment, and institutional grade operations [8].

The bottom line: Private equity's appetite for Texas car washes isn't slowing down. Platforms are actively building regional networks, and quality assets with strong membership bases are commanding premium valuations. If you're considering selling, now is the time to prepare. The owners who methodically address valuation drivers, organize their financials, and engage experienced advisors are best positioned to capture this opportunity.

Demand is driven by private equity backed platforms, regional consolidators, independent investors, and net lease real estate buyers, all competing for high quality Texas locations [16]. This consolidation wave creates opportunities for owners who understand valuation drivers and prepare properly.

For owners, the path to a premium sale price lies in preparing professional grade financials and KPI reporting, optimizing recurring revenue via unlimited membership programs, investing selectively in equipment and operational systems, and engaging specialized car wash advisors who understand the dynamics of private equity, strategic buyers, and real estate investors.

Given the current consolidation cycle and the sector's strong fundamentals, Texas car wash owners who methodically prepare and position their assets are well positioned to capture attractive valuations over the next several years.

Considering selling your Texas car wash? Contact me for a consultation. I can help you understand your car wash's value, identify the right buyers, and guide you through the entire sale process.

Have questions about preparing your car wash for sale? Contact me to discuss your specific situation and develop a preparation strategy that maximizes value.

Sources and References

[1] BizBuySell. Car Washes For Sale in Texas

[2] Peak Business Valuation. (2025, January 17). Valuation Multiples for a Car Wash

[4] BizQuest. Texas Car Washes For Sale

[5] Team DeJoy. (2023, June 6). Car Wash Valuation: How to Clean Up

[6] Car Wash Advisory. (2025, December 17). ClearWater Express Wash Acquires BlueWave Express Car Wash

[7] LoopNet. Car Washes For Sale in Texas

[8] First Page Sage. (2025, February 5). Car Wash EBITDA & Valuation Multiples – 2025 Report

[10] Realmo. Texas Car Washes for Sale

[11] Car Wash Advisory. (2024). 2024 Carwash M&A Report

[12] Red Dog Equity. (2023). Mammoth Holdings Acquires Galaxies Express Car Wash in Killeen, Texas

[13] Holland & Knight. (2019, May 1). Holland & Knight Leads Car Wash Private Equity Acquisition in Texas

[15] Reuters. (2024, February 15). Quick Quack Car Wash Explores Minority Stake Sale, Sources Say

[16] PE Hub. (2024, June 13). Private Equity Still Loves Car Washes: 6 More Deals

[17] Calder Capital / Calder Group. (2025, August 26). Car Wash M&A Business Brokers / Investment Banking

[18] PPR Capital Management. (2025, January 19). PPR Capital Opens 2 Tommy's Express Car Wash Locations

[19] CarWashBizCenter. (2025, September 15). Brokers for Car Wash Businesses

[20] Amplify Capital Group. (2025, October 7). What's Driving New Car Wash M&A Interest?

[22] Foresite Commercial Real Estate. (2019, January 6). Selling Your Car Wash Business: 3 Key Lessons

[23] PE Hub & related deal coverage. (2024). Private Equity Activity in the Car Wash Sector

[24] CarWashKing.com. (2024, October 31). Car Wash Business For Sale

[25] Car Wash Advisory. Sell Your Texas Car Wash

[26] Facebook Marketplace. (2026, January 3). Car Wash Business and Real Estate for Sale in Conroe, TX

About the Author

Jenesh Napit is an experienced business broker specializing in business acquisitions, valuations, and exit planning. With a Bachelor's degree in Economics and Finance and years of experience helping clients successfully buy and sell businesses, he provides expert guidance throughout the entire transaction process. As a verified business broker on BizBuySell and member of Hedgestone Business Advisors, he brings deep expertise in business valuation, SBA financing, due diligence, and negotiation strategies.

You might also be interested in

Free Business Calculators

Try our business valuation calculator and ROI calculator to estimate values and returns instantly.

How to Buy a Business Guide

Download our comprehensive free guide covering everything you need to know about buying a business.

Our Services

Explore our professional business brokerage services including valuations and buyer representation.

More Articles

Browse our complete collection of business brokerage insights and expertise.