2026 is your last best window to exit your marketing agency at peak value. Here's why:

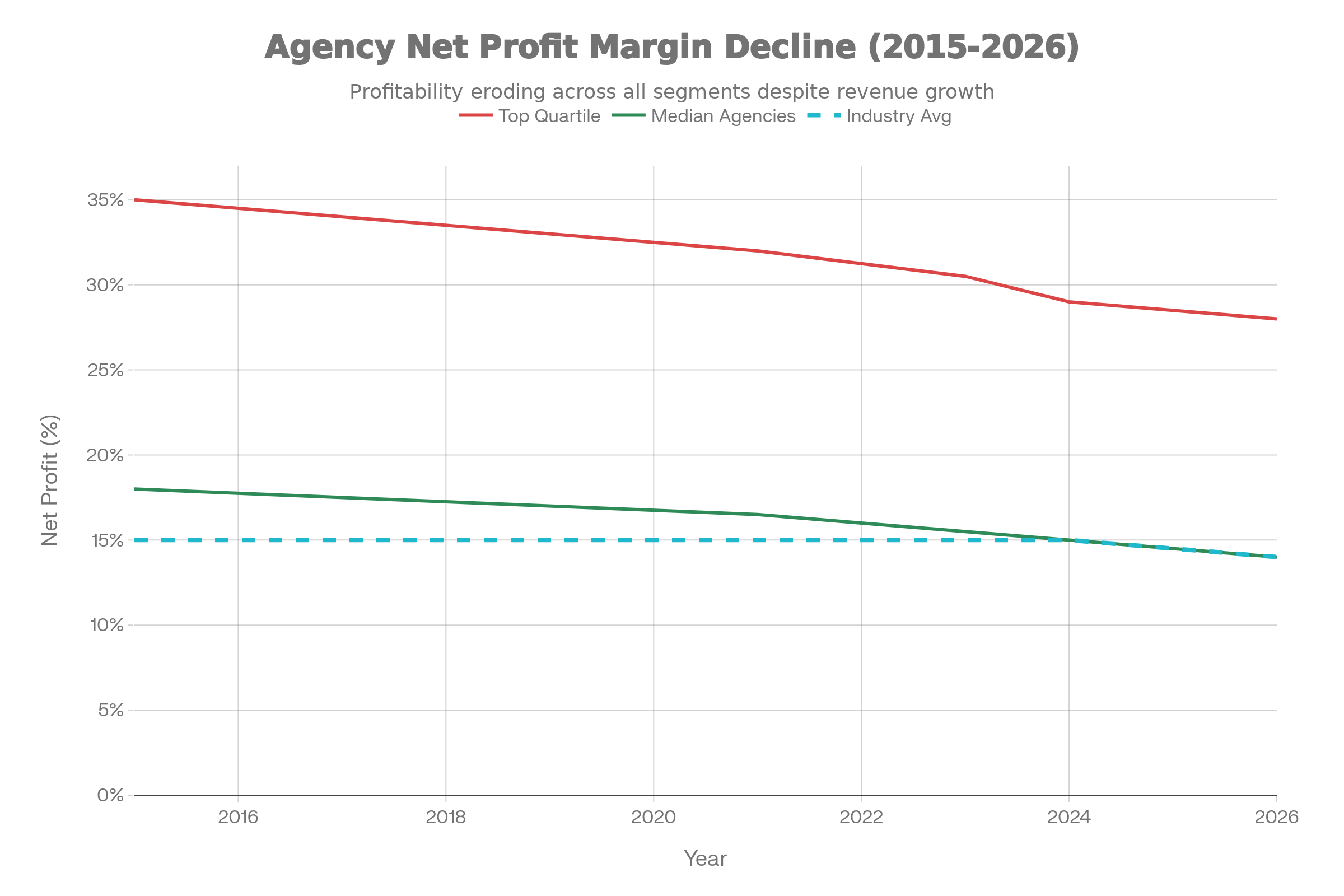

- Profitability is at peak levels but margins are collapsing (15-20% average, down from 18% in 2015)

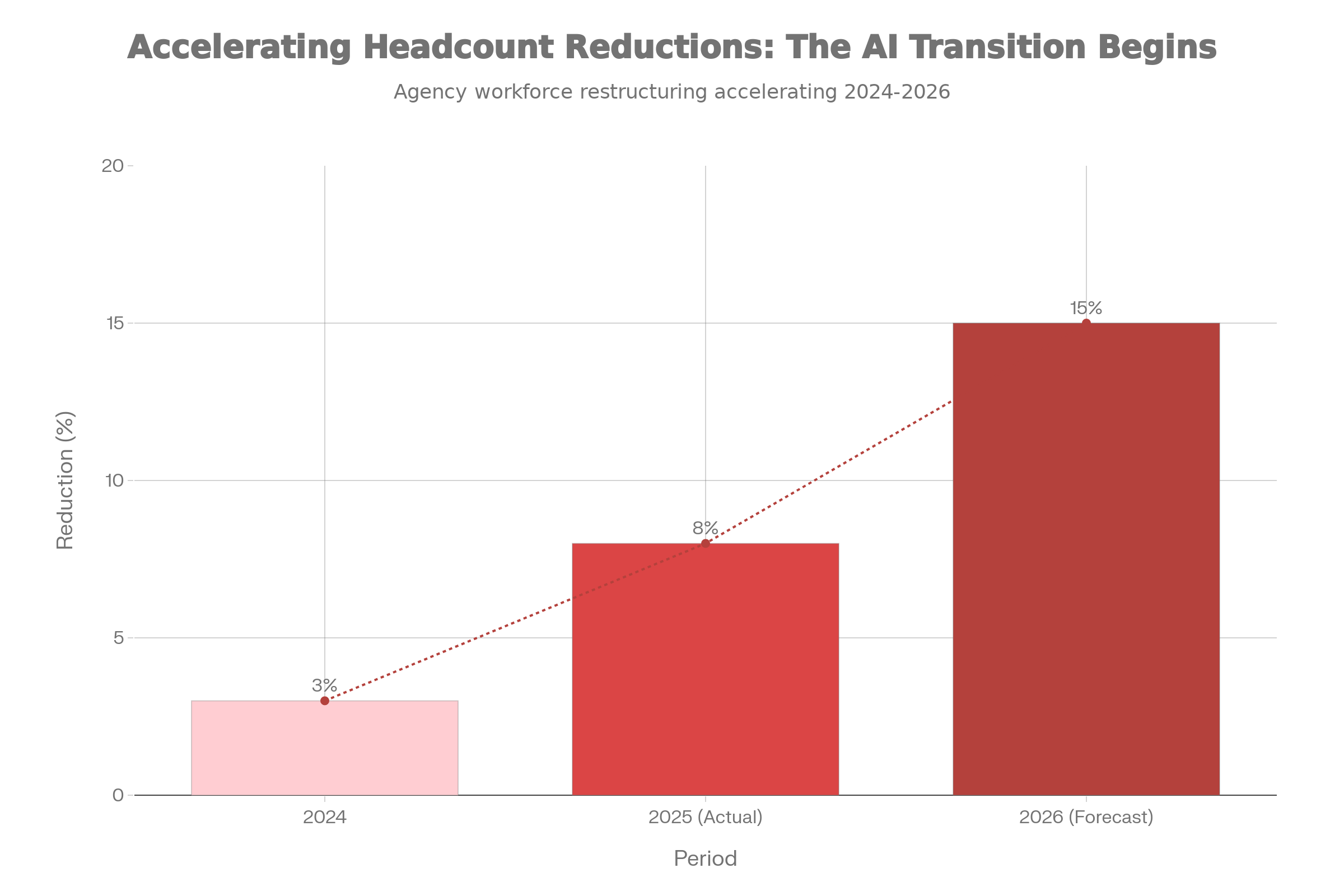

- Headcount reductions are accelerating (8% in 2025, 15% forecasted for 2026)

- AI is replacing 95% of agency services according to OpenAI CEO Sam Altman

- Valuation multiples are strong now (6-9x EBITDA) but will compress as AI disruption accelerates

- Buyer demand is high but will shift toward AI enabled agencies, leaving traditional agencies behind

The data from the Marketing Agency Market Analysis 2026 shows that marketing agencies face a profitability crisis, AI disruption, and structural decline. While global digital advertising spend reaches $740 billion, agencies are trapped in a margin squeeze that makes 2026 the critical exit window before traditional agency models become indefensible.

After working with dozens of marketing agency owners on exits, I've seen the pattern: owners who sell in 2026 exit at peak value. Those who wait face a market where AI enabled agencies command premium multiples and traditional agencies face multiple compression.

Download the full case study here.

Enter your name and email to receive the complete Marketing Agency Market Analysis 2026 PDF report.

The Profitability Crisis: Why Margins Are Collapsing

Deteriorating Margins Across the Industry

Marketing agencies are experiencing a profitability squeeze that defies headline revenue growth. While digital advertising spend sounds substantial, the path to profitability is increasingly treacherous.

| Metric | Current Industry Average | Top Quartile Performance |

|---|---|---|

| Net Profit Margin | 15-20% | 30%+ |

| Gross Profit Margin | 40-50% | 50%+ |

| Overhead Ratio | 50-100% of revenue | 25%+ of revenue |

| Client Utilization Rate | 65-75% | 80%+ |

Source: Marketing Agency Market Analysis 2026 [1]

The sobering reality: digital agencies have maintained an average net margin of 15% since 2015, representing one of the lowest margin professional services sectors [2]. The chart above shows the structural profitability decline from 2015-2026, with top quartile agencies declining from 35% margins to 28%, while median agencies compressed from 18% to 14%.

Why Margins Are Collapsing

The margin collapse stems from four structural factors:

1. Shift from Retainers to Project Based Work

- Retainer agreements (the foundation of predictable, profitable agency economics) have been replaced by low margin, project based work [1]

- This structural shift means:

- Reduced revenue predictability

- Higher cost of client acquisition

- Inability to amortize overhead across stable revenue bases

- Constant pressure to replace departing clients

2. In Housing and Insourcing Accelerates

- Clients are systematically bringing marketing functions in house [1]

- When brands realize they can hire one or two marketing professionals for the cost of a retainer, the economic calculus becomes obvious

- Unlike agencies that must support overhead, brands can absorb these costs directly into their P&L

3. Scope Creep and Project Overruns

- The average cost of scope creep per project is $8,700 for mid size agencies [3]

- Project overruns occur in 10-20% of initiatives, eroding 5-15% of profit margins per project [4]

- A project that balloons from 100 hours to 115 hours has already lost 15% of its profit

4. Hidden Profitability Leaks

- Nearly 47% of agencies lose up to $500,000 annually on untracked hours [5]

- These missing hours create compounding problems:

- Distort future scoping and lead to chronic under pricing

- Repeat cycle of margin destruction across subsequent projects

- Make it impossible to understand true client and project profitability

Verdict: Agencies operating in the "messy middle" (11-50 employees) experience a structural 10-15 point utilization dip that creates a 60-75% net margin ceiling [5].

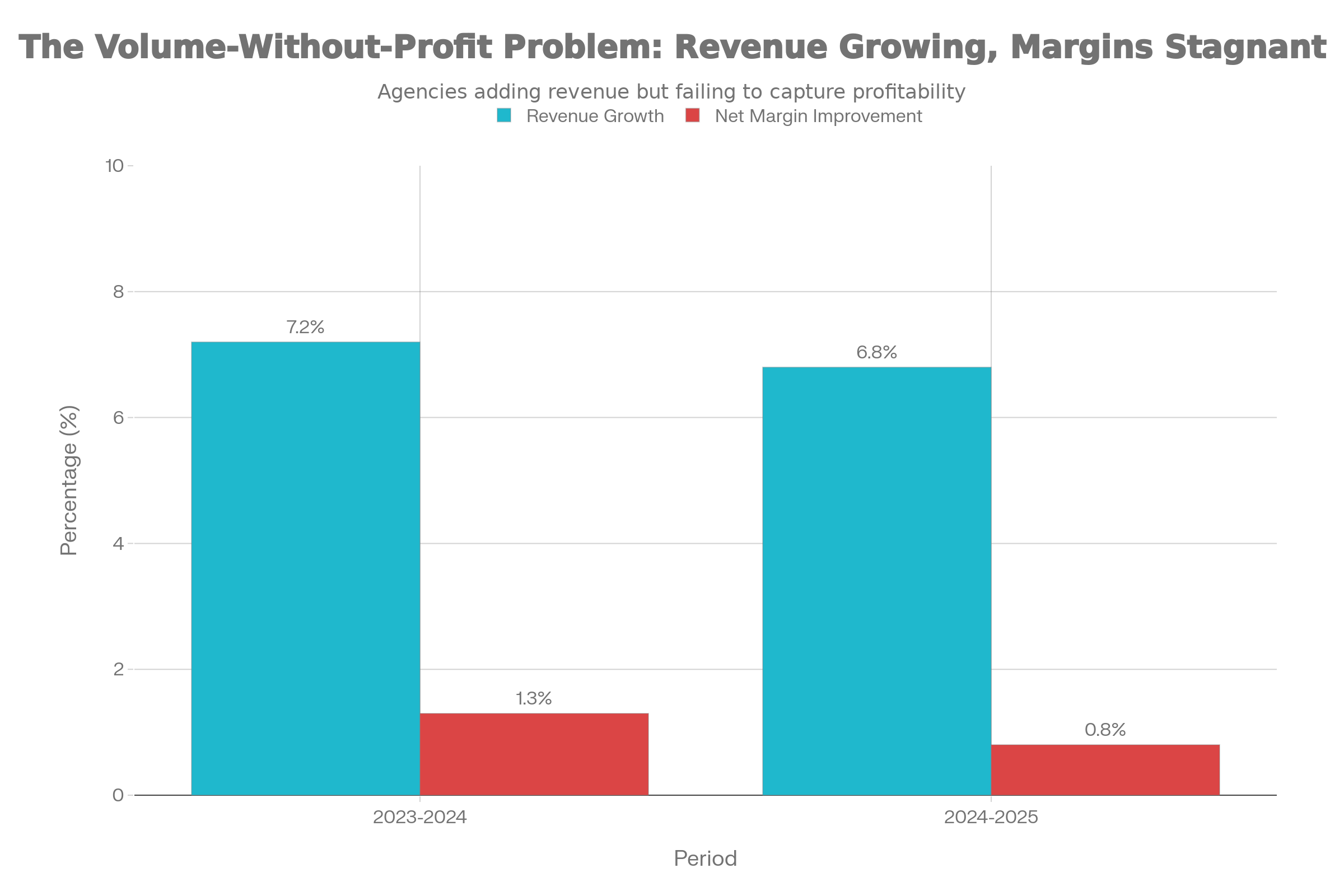

The revenue profit divergence problem is acute: while agencies have grown revenue 6-7% annually from 2023-2025, net margin improvement has stalled at under 1%. This decoupling reveals agencies are adding volume without capturing profitability.

Want to understand what your marketing agency might be worth in this market? Use our free business valuation calculator to get an estimate based on current market conditions.

The AI and Automation Disruption: Structural Threat to Labor Economics

The Fundamental Business Model Problem

Marketing agencies operate on a labor arbitrage model: billable hours sold at rates exceeding the cost of the labor to deliver them. This model is incompatible with AI driven automation.

According to Forrester research [6], the scope of the challenge is clear:

- 8% headcount reduction in 2025 (already occurring)

- 15% headcount reduction forecasted for 2026 (accelerating)

- After an average 8% cut in 2025, another 15% is planned for 2026 [6]

This is not gradual efficiency. It's rapid workforce restructuring.

Why AI Threatens Agencies Specifically

1. 95% of Agency Work Could Be Automated

OpenAI CEO Sam Altman has stated that "95% of what marketers use agencies, strategists, and creative professionals for today will easily, nearly instantly and at almost no cost be handled by the AI" [7].

While this prediction may prove overblown, the trajectory is unmistakable. Core agency deliverables are increasingly automatable:

- Strategy development

- Content creation

- Media planning

- Campaign optimization

2. Agencies Are Unprepared

Most ad agencies lack the foundational infrastructure required for AI implementation [7]:

- Data infrastructure is broken: Disparate systems, siloed data, reliance on Excel spreadsheets that cannot integrate with AI systems

- Skills gap is severe: Most agencies lack data scientists, machine learning engineers, and AI experts [8]

- Only 23.2% of global marketers have adequate internal resources to implement AI and automation successfully [9]

3. The Competitive Collapse

Agencies that embrace AI will immediately undercut those that don't. As Josh Chasin observes: "The agencies that don't embrace AI are going to find that they've got a competitive problem because they are offering the same services as their competitors, but they're spending too much to do it" [7].

This creates a race to the bottom: agencies forced to cut prices to compete with AI efficient competitors, further collapsing already thin margins.

Verdict: The next 18-24 months represent the final period where legacy agencies can command traditional service fees. As AI adoption accelerates in 2026, pricing power will evaporate.

Rising Demand Masking Falling Profitability: The Volume Without Profit Problem

The Paradox

The headline sounds bullish: global digital ad spend is projected to reach $740 billion by 2026 [10], up from $626 billion in 2023. But this masks a deteriorating unit economics problem.

| Factor | 2023-2024 | 2025-2026 Outlook |

|---|---|---|

| Global Ad Spend Growth | +7-8% | +6.7% (slowing) |

| Digital Ad Spend Growth | +8.5% | +6.7% |

| Performance Efficiency | Stable | Declining across channels |

| Cost Per Acquisition (CPA) | Rising | Rising faster |

| Return on Ad Spend (ROAS) | Stable | Declining |

| Marketer Confidence in ROI Measurement | High | Down 7 percentage points |

Source: Marketing Agency Market Analysis 2026 [10][11]

Why This Matters to Agencies

Brands are spending more to achieve the same (or worse) results. This creates critical problems:

- Clients demand better ROAS from the same budget → Agencies forced to work more for same fee

- Attribution confidence collapsing → Only 30% of CMOs feel confident measuring ROI [11]

- Measurement becomes adversarial → Clients blame agencies for measurement failures, demand fee reductions

The Structural Decline of Agency Differentiation

Search, Social, and Programmatic Are Commodities

The traditional agency value proposition rested on scarce expertise: How do you succeed in SEO? Social media? Media buying? These are now commodity services available from technology platforms, consultants, and in house teams [12].

2026 Trends Confirm Erosion

Several structural trends in 2026 will further erode agency positioning:

Trend 1: Retail Media Becomes Core

- Retail media networks (Amazon, Walmart, Target) are expected to capture $69.3 billion in U.S. ad spending by 2026 [13]

- This spending flows directly to platforms, bypassing traditional agencies

Trend 2: Influencer Marketing Fragmentation

- Global influencer marketing market reaches $24 billion by 2026 [14]

- Brands work directly with influencers and platforms, reducing agency role

Trend 3: AI Native Applications

- Forrester predicts [15] AI native applications will replace traditional agency services

- These applications handle strategy, creative, and optimization without agency intermediaries

Industry Consolidation: The Writing on the Wall

Holding Company Mergers Signal Market Stress

The Omnicom and Interpublic merger [16] kicks off another era of ad industry consolidation. This signals:

- Market pressure requiring scale to compete

- Need for efficiency through consolidation

- Reduced buyer options for smaller agencies

Measurement Confidence Collapsing

Forrester research shows [17] that measurement confidence is collapsing:

- Only 30% of CMOs feel confident measuring ROI [11]

- This creates adversarial relationships between agencies and clients

- Agencies face blame for measurement failures, leading to fee reductions

Market Timing: Why 2026 Is The Critical Exit Window

The Valuation Compression Timeline

The Marketing Agency Market Analysis 2026 reveals a clear valuation compression timeline:

| Period | Market Condition | Valuation Impact |

|---|---|---|

| Q1-Q4 2026 | Critical Exit Window | 6-9x EBITDA (current multiples) |

| 2027 | Compression Phase Begins | Multiples decline 20-30% |

| 2028 | Full Disruption Realized | $30M agency worth $45M in 2026 vs. $45M in 2028 |

The "Critical Exit Window" of Q1-Q4 2026 represents the last period where valuations remain resilient before the compression phase begins.

Factors Making 2026 The Sweet Spot

- Strong buyer demand from strategic acquirers and private equity firms

- Favorable financing conditions that enable buyers to pay premium multiples

- High agency profitability that supports strong valuations

- Industry consolidation that creates multiple buyer options

- AI adoption widespread but not yet universal (buyers still see value in traditional agencies)

These conditions won't last forever. As AI disruption accelerates, buyer demand will shift toward AI enabled agencies, leaving traditional agencies with fewer options.

Buyer Market Dynamics in 2026

Who's Buying Marketing Agencies

The buyer market for marketing agencies in 2026 includes:

- Strategic acquirers: Larger marketing agencies and holding companies seeking to expand

- Private equity firms: Financial buyers looking for platform investments or add on acquisitions

- Individual buyers: Entrepreneurs and operators seeking to enter or expand in the marketing industry

- Technology companies: Companies looking to add marketing capabilities to their platforms

Expected Valuations

Based on the Marketing Agency Market Analysis 2026:

- 6-9x EBITDA for solid mid market agencies

- Below historical averages, but likely to compress further

- Premium multiples for agencies with:

- Strong recurring revenue (50%+)

- Net margins above 25%

- Technology infrastructure and AI adoption

- Diversified client base (no single client >20% of revenue)

Ready to explore your exit options while profitability is high? Contact us to discuss how current market conditions and profitability trends affect your agency's valuation.

Common Mistakes Marketing Agency Owners Make When Timing Their Exit

Mistake 1: Waiting Too Long for Perfect Conditions

Many agency owners wait for perfect conditions before selling. They think they need to hit a specific revenue number, land a big client, or achieve some other milestone.

The reality: Perfect conditions rarely arrive. The data shows agencies selling in 2026 are exiting at optimal conditions, but those conditions won't last forever.

Mistake 2: Not Recognizing Market Peaks

Some agency owners don't recognize when they're at a market peak. They see strong profitability and think it will continue indefinitely.

The reality: Market peaks are temporary. The data shows marketing agency profitability is at a peak in 2026. Agencies selling at market peaks get premium valuations.

Mistake 3: Ignoring Industry Consolidation Signals

Industry consolidation is a clear signal that the market is changing. When larger agencies acquire smaller ones, smaller agencies will face increasing competitive pressure.

The reality: Consolidation creates exit opportunities, but also signals market changes that may make waiting less attractive.

Mistake 4: Underestimating Technology Disruption

The biggest mistake agency owners make is underestimating technology disruption. Many owners think AI tools are just efficiency improvements, not fundamental threats.

The reality: AI disruption is accelerating. Agencies that don't adapt will face increasing pressure. Underestimating this disruption means missing the optimal exit window.

Mistake 5: Holding Too Long and Missing the Window

Some agency owners hold too long because they're emotionally attached or think conditions will improve.

The reality: The optimal exit window for marketing agencies is closing. Holding too long means missing the window and facing a less attractive market.

What Your Agency Might Be Worth in 2026

Valuation Methodologies

Marketing agencies are typically valued using multiple methodologies:

- Revenue multiples: 2 to 5 times annual revenue (depending on profitability, growth, client concentration)

- EBITDA multiples: 6 to 10 times EBITDA (for profitable agencies)

- SDE multiples: 3 to 6 times seller's discretionary earnings (for smaller agencies)

Typical Multiples for 2026

Based on the Marketing Agency Market Analysis 2026:

- Revenue multiples: 2.5 to 4.5 times annual revenue for agencies with strong fundamentals

- EBITDA multiples: 6 to 9 times EBITDA for profitable agencies

- SDE multiples: 3.5 to 5.5 times SDE for smaller agencies

Factors That Increase Value

- Recurring revenue: High percentages of recurring revenue command premium multiples

- Client diversification: Diversified client bases are less risky and more valuable

- Strong margins: High profitability supports higher multiples (25%+ net margin)

- Growth trajectory: Strong growth potential commands premium valuations

- Technology adoption: Modern technology infrastructure and AI adoption increase value by 20-30%

- Proven systems: Documented processes and systems make agencies easier to integrate

Want to see what your marketing agency might be worth? Use our free business valuation calculator to get an estimate based on current market conditions and typical multiples.

Preparing Your Agency for a 2026 Exit

Financial Preparation

- Separate personal and business expenses: Clean financials that clearly show business performance

- Professional accounting: Use professional accountants to prepare financial statements

- Document everything: Maintain detailed records of revenue, expenses, and profitability

- Show trends: Demonstrate consistent profitability and growth over multiple years

Operational Improvements

- Documented processes: Operations manuals and process documentation

- Standardized systems: Consistent systems for delivering services

- Efficient operations: Streamlined operations that maximize profitability

- Scalable processes: Systems that can scale with growth

Client Diversification

- Reduce client concentration: No single client should represent more than 20% of revenue

- Build recurring revenue: Convert project based revenue to recurring revenue

- Diversify service offerings: Reduce dependence on any single service line

Team Structure Optimization

- Develop management team: Create a management team that can operate without the owner

- Document roles: Clearly define roles and responsibilities

- Cross train staff: Ensure multiple people can handle critical functions

- Reduce key person risk: Minimize dependence on any single individual

Technology Integration

- Modern technology infrastructure: Up to date systems and tools

- AI adoption: Use of AI tools to improve efficiency and competitiveness

- Automated processes: Automation of routine tasks to improve margins

- Data systems: Systems for tracking performance and making data driven decisions

Ready to prepare your agency for a 2026 exit? Contact us to discuss preparation strategies and explore how to maximize your agency's value.

The Risks of Waiting: What Could Change After 2026

AI Disruption Accelerating

- AI tools will become more capable

- Adoption will become universal

- Traditional agencies will face increasing pressure

- AI enabled agencies will command premium multiples

- Traditional agencies will face multiple compression

Market Conditions That Could Deteriorate

- Economic conditions could change

- Buyer demand could decrease

- Financing conditions could tighten

- These changes would make exits less attractive and reduce valuations

Technology Disruption Making Traditional Agencies Obsolete

- Services that agencies built their businesses around are being commoditized

- Clients are beginning to question why they need agencies when AI can handle many marketing tasks

- This disruption will accelerate after 2026

Increased Competition from AI Powered Solutions

- AI powered solutions deliver marketing services at lower costs and with greater efficiency

- This puts pressure on traditional agency pricing and margins

- Competition will increase as AI tools become more capable

Buyer Market Cooling

- Buyer demand for traditional agencies may cool as AI becomes more capable

- Buyers may prioritize AI enabled agencies and avoid traditional agencies

- This would reduce buyer competition and compress multiples

Valuation Multiple Compression

- Multiples may compress as agencies become less valuable due to AI disruption

- Buyers may become more cautious about traditional agencies

- This would reduce multiples and make exits less attractive

Need help understanding how AI disruption affects your agency's value? Contact us to discuss your specific situation and explore exit options.

What To Do Next: Action Steps for Agency Owners

Step 1: Evaluate Your Agency's Readiness

Assess:

- Financial performance: Is profitability strong and consistent?

- Client concentration: Is client base diversified?

- Team structure: Can the agency operate without the owner?

- Technology adoption: Has the agency adopted modern technology and AI tools?

- Market position: How does the agency compare to competitors?

Step 2: Get a Professional Valuation

A professional valuation will:

- Provide market context: Show how your agency compares to others

- Identify value drivers: Highlight factors that increase or decrease value

- Set expectations: Help you understand realistic valuation ranges

- Guide preparation: Show what improvements could increase value

Step 3: Prepare Financial Documentation

- Separate personal and business expenses: Ensure financials clearly show business performance

- Use professional accounting: Work with professional accountants to prepare financial statements

- Document everything: Maintain detailed records of revenue, expenses, and profitability

- Show trends: Demonstrate consistent profitability and growth over multiple years

Step 4: Identify Potential Buyers

The buyer market includes:

- Strategic acquirers: Larger marketing agencies and holding companies

- Private equity firms: Financial buyers looking for platform investments

- Individual buyers: Entrepreneurs and operators seeking opportunities

- Technology companies: Companies looking to add marketing capabilities

Step 5: Work With Experienced Brokers or Advisors

Experienced professionals can:

- Guide preparation: Help you prepare your agency for sale

- Identify buyers: Connect you with qualified buyers

- Negotiate terms: Help you negotiate favorable terms and valuations

- Manage process: Guide you through the entire exit process

Ready to explore your exit options? Contact us to discuss your agency's situation and explore how we can help you maximize your exit value.

Conclusion

The data from the Marketing Agency Market Analysis 2026 is clear: 2026 represents the optimal exit window for marketing agency owners. Profitability is at peak levels, buyer demand is strong, and valuations are historically high. But this window is closing as AI disruption accelerates.

Key findings:

- Profitability margins are collapsing (15-20% average, down from 18% in 2015) [1]

- Headcount reductions are accelerating (8% in 2025, 15% forecasted for 2026) [6]

- AI is replacing 95% of agency services [7]

- Valuation multiples are strong now (6-9x EBITDA) but will compress

- Buyer demand is high but will shift toward AI enabled agencies

Agencies selling in 2026 are commanding premium multiples because buyers see value in established client relationships and proven systems. But those same buyers are also investing heavily in AI capabilities, which means they're less interested in agencies that rely on traditional manual processes.

After 2026, the market will change. AI adoption will become universal, buyers will prioritize AI enabled agencies, and traditional agencies will face multiple compression. This means the window for optimal exits is closing, and agency owners who wait risk facing a less attractive market.

If you're a marketing agency owner considering an exit, the message from the data is clear: 2026 is your last best window to exit at peak value. Profitability is high, buyer demand is strong, and valuations are favorable. But these conditions won't last forever. AI disruption is accelerating, and agencies that don't adapt will become less valuable over time.

The opportunity is there. The market conditions are optimal. The question is: will you act now to capture peak value, or will you wait and risk facing a market where traditional agencies are at a significant disadvantage?

Ready to explore your exit options while market conditions are optimal? Contact us to discuss your agency's situation and explore how we can help you maximize your exit value in 2026.

Want to understand what your marketing agency might be worth in current market conditions? Use our free business valuation calculator to get an estimate based on typical multiples and current market trends.

Sources and References

[1] Forbes. (2025). Marketing Agencies In 2026: Reshaping Strategies For A New Era

[2] Bionic Advertising Systems. (2024). Most Ad Agencies Are Not Ready for AI

[3] Advids. (2024). The Cost of Scope Creep in Digital Marketing Projects. Industry research on project overrun costs.

[4] Workamajig. (2024). Project Management in Creative Agencies: Benchmarking Report. Agency project management and overrun rates.

[5] TMetric. (2025). Marketing Agency Profitability Benchmarks: 2025

[6] Forrester. (2025). Predictions 2026: Marketing Agencies Resign Their Agency

[8] Algomarketing. (2023). Challenges of AI & Automation in Marketing. Global research on AI implementation barriers across 300 marketing leaders.

[9] Algomarketing. (2023). AI & Automation Index for Global Marketing Operations

[10] CoolNerds Marketing. (2025). 19 Digital Marketing Trends for 2026. Digital advertising spend projections from Statista.

[11] Gartner. (2025). CMO Spend Survey and Marketing Analytics Trends

[12] CoolNerds Marketing. (2025). 19 Digital Marketing Trends for 2026. Search and channel fragmentation analysis.

[13] eMarketer. (2025). U.S. Retail Media Ad Spending Projections 2026. Retail media growth forecast.

[14] Influencer Marketing Hub. (2025). Influencer Marketing Benchmark Report. Global influencer marketing market size and growth.

[15] Marketing Dive. (2025). Will 2026 be more volatile for marketing? Here's what the numbers say. Forrester report on AI native applications.

[17] Marketing Dive. (2025). Will 2026 be more volatile for marketing? Here's what the numbers say. Measurement confidence projections.

About the Author

Jenesh Napit is an experienced business broker specializing in business acquisitions, valuations, and exit planning. With a Bachelor's degree in Economics and Finance and years of experience helping clients successfully buy and sell businesses, he provides expert guidance throughout the entire transaction process. As a verified business broker on BizBuySell and member of Hedgestone Business Advisors, he brings deep expertise in business valuation, SBA financing, due diligence, and negotiation strategies.

You might also be interested in

Free Business Calculators

Try our business valuation calculator and ROI calculator to estimate values and returns instantly.

How to Buy a Business Guide

Download our comprehensive free guide covering everything you need to know about buying a business.

Our Services

Explore our professional business brokerage services including valuations and buyer representation.

More Articles

Browse our complete collection of business brokerage insights and expertise.